Financial Aid Application Completion Night

Sick Leave

Each eligible faculty member shall be entitled to accumulate a maximum of 410 days (3280 hours).

Personal Leave

All full-time employees earn 3 days per fiscal year (unused days are added to sick leave; however, are excluded from SURS reporting upon separation/retirement).

Sabbatical

After the completion of watch six or more consecutive years of uninterrupted full -time faculty employment with District No.525, any tenured faculty member will qualify for consideration for a sabbatical (of not more than two semesters or less than one semester) subject to procedures in contract Sections 10.5, 10.6 10.7.

Bereavement

An employee may be granted 3 bereavement leave days for the death of an immediate family member. And additional 1 day may be granted for extenuating circumstances.

Jury Leave

The college supports employees in their civic duty to serve on a jury. Full-time employees will be paid for jury duty service at their regular rate of pay minus any compensation received from the court for the period of service.

Military Leave

The college complies with all provisions of the Uniformed Services Employment and Reemployment Rights Act (USERRA) and the Illinois Service Member Employment and Reemployment Rights Act (ISERRA) in support of the military obligations of employees. These Acts protect the employment, reemployment, benefits, and prevent discrimination of service members who leave their civilian employment to serve our nation or state.

Family and Medical Leave (FMLA)

JJC complies with the federal Family and Medical Leave Act (FMLA), which requires employers to grant unpaid leaves of absence to qualified workers for certain medical and family-related reasons. The college abides by any state regulated leave laws. The more generous of the two laws will apply to the employee if the employee is eligible under both federal and state laws.

Time off for Voting

JJC recognizes that voting is an integral part of being in a community. In almost all cases, and employee will have sufficient time outside working hours to vote. If for any reason this won’t be the case, the employee should contact their supervisor to discuss scheduling accommodations. In Illinois every employee is entitled, after giving sufficient notice, to two hours off work, provided that the employee's working hours begin less than 2 hours after the opening of the polls and end less than 2 hours before the closing.

State Universities Retirement System (SURS)

The college participates in SURS and all employees, except student workers and those employees that are considered temporary or intermittent, are required to contribute eight percent (8%) of their gross pay.* This contribution is a pre-tax deduction. The employer contribution is paid by the state of Illinois. Employees that contribute to SURS do not contribute to the Federal Social Security Program (FICA).

General information regarding SURS may be accessed toll free by calling 1-800-ASK SURS (275-7877) or visiting the SURS website. *Employees hired as Campus Police Officers are subject to a higher SURS contribution.

State of Illinois College Insurance Program (CIP)

The State of Illinois College Insurance Program (CIP) provides health, dental, and vision benefits for retired employees of public Illinois community colleges. Full-time employees must contribute 0.95% of their gross pay. This required contribution is one of four sources designed to fund the state community college health insurance program. This program is administered through SURS and the State of Illinois. SURS website

SURS Deferred Compensation Plan (DCP)

SURS offers a supplemental defined contribution plan. This voluntary plan provides employees an avenue to save more and generate additional income in retirement. To make it convenient for employees to build additional savings, newly certified members will be automatically enrolled. The contribution rate will be 3%, deducted before taxes from your paycheck. SURS website

Tax Sheltered Annuity Program 403(b) and 457(b)

The college provides all employees the opportunity to participate in a Tax-Sheltered Annuity Program. The college has pre-approved companies from which employees can choose a tax deferred investment plan. The college does not contribute to these accounts.

Tuition Waiver

Full-time employees, their spouses, and eligible dependents (eligible dependent children include those who are unmarried and under the age of twenty-six (26) and are dependent upon the employee for support and maintenance at the commencement date of the class) will be granted a waiver for tuition to participate in the Joliet Junior College credit classes. This benefit does not include a waiver for course fees, which will be paid by the employee.

Wellness Center

Employees may join the Wellness/Fitness Center. Currently membership is free for employees.

Blue Cross Blue Shield IL – Medical Insurance

The college provides two medical insurance plan choice options (PPO, HMO) through Blue Cross Blue Shield of Illinois, for the employee and eligible dependents, effective the 1st day of employment. Employee contribution towards cost of health/dental/prescription insurance is based on a formula, which includes the insurance premium equivalency, employee salary and other factors. Contributions are made on a pre-tax basis.

Prescription Plan

Prescription coverage is provided by Express Scripts for the PPO and by Prime Therapeutic for the HMO.

Blue Cross Blue shield IL- Dental Insurance

Dental insurance (core plan) is provided and included with the base medical employee contribution. An employee may “buy -up” for additional coverage.

Vision Service Plan (VSP)

VSP is Joliet Junior College’s provider for vision care and discounts. Vision insurance (core plan) is included with the base medical employee contribution. An employee may “buy-up” for additional coverage.

Term Life / Voluntary Life / Long Term Disability (LTD)

The college provides $30,000 of term life insurance coverage and double indemnity coverage for the employee at no cost in case of accidental death and dismemberment, effective immediately on the 1st day of full-time employment.

The college provides employees the opportunity to purchase additional life insurance at their own cost, for themselves and their dependents.

Long Term Disability is available at a minimal cost as a supplement to the provisions of the State Universities retirement System (SURS).

Critical Illness

Employee voluntary critical illness insurance provides a fixed, lump sum benefit upon diagnosis of critical illness, which can include heart attack, stroke, paralysis, and more.

FSA / DCA / Commuter

The college provides an IRS Section 125 Flexible Spending Account (FSA). The plan allows for pre-tax deduction by the full-time employees for the purpose of paying reimbursable medical, dental, hearing, vision, dependent care and commuter expenses as per IRS limitations. The employee is eligible to participate in plan the 1st day of employment.

Employee Assistance Program

The college provides access to an Employee Assistance Program (EAP) for employees and their eligible dependents. Our EAP is offered through Evernorth; an integrated employee assistance and work/ life program. Highlights of this benefit include:

Health Screening

Every, fall, JJC provides free annual health screening and lab work to retirees, employees, spouse and/or dependents.

Pet Insurance by MetLife

MetLife Pet Insurance is a voluntary benefit that can not only help cover the cost of unexpected accidents and illnesses, but also things like routine care.

Automotive

The Joliet Junior College Automotive Service Technology Shop provides services to the vehicles of employees in order to provide hands-on experience for its automotive program’s students. The employee will be invoiced for all parts and nominal service fee in lieu of labor charges.

Dining Cafe

A loyalty program to reward employees for your on-going patronage throughout the year regardless of if you pay with cash, credit/debit card or order online. Your points can be redeemed with rewards for discounts on food and drink.

Direct Deposit

Joliet Junior College Employees are encouraged to enroll in direct deposit and may divide their paycheck among multiple accounts.

The description above is a summary of the current benefit program offered and is not intended to be an all-inclusive statement or guarantee of benefits.

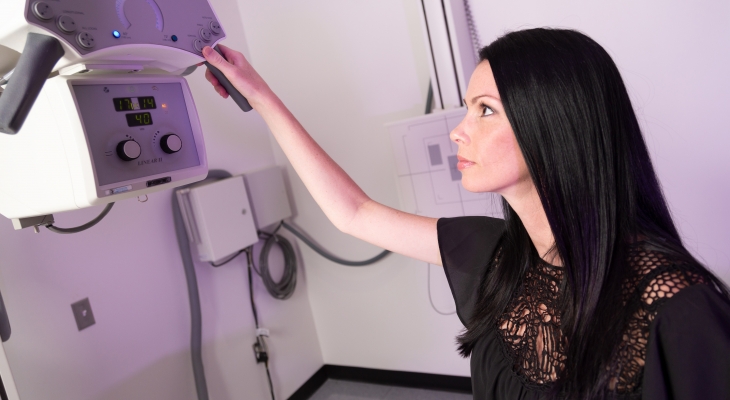

The application for the radiologic technology program will be open from Nov. 1 through Nov. 30. The Radiologic...