Financial Aid Application Completion Night

Sick Leave

All full-time employees earn 20 days of sick leave accumulative up to maximum of 360 days.

Vacation

Accrual schedules vary depending on the employee's length of employment:

(1-5 years) 10 days per fiscal year

(6+years) 20 days per fiscal year

Personal Leave

All full-time employees earn 3 days per fiscal year (unused days are added to sick leave; however, are excluded from SURS reporting upon separation/retirement).

Holidays

The Office of Human Resources will distribute a list of holidays for each fiscal year upon approval by the Board of Trustees.

Floater Holiday

After five years of continuous full-time service, the employee will be granted 1 floater holiday per fiscal year. After fifteen years of continuous full-time-service, the employee will receive a second floater holiday, equal to 2 per fiscal year.

Bereavement

An employee may be granted 3 bereavement leave days for the death of an immediate family member. An additional 1 day may be granted for extenuating circumstances. If 5 or more days are needed, sick leave (with appropriate documentation), personal leave or vacation days may be used.

Jury Leave

The college supports employees in their civic duty to serve on a jury. Full-time employees will be paid for jury duty service at their regular rate of pay minus any compensation received from the court for the period of service.

Military Leave

The college complies with all provisions of the Uniformed Services Employment and Reemployment Rights Act (USERRA) and the Illinois Service Member Employment and Reemployment Rights Act (ISERRA) in support of the military obligations of employees. These Acts protect the employment, reemployment, benefits, and prevent discrimination of service members who leave their civilian employment to serve our nation or state.

Family and Medical Leave (FMLA)

JJC complies with the federal Family and Medical Leave Act (FMLA), which requires employers to grant unpaid leaves of absence to qualified workers for certain medical and family-related reasons. The college abides by any state regulated leave laws. The more generous of the two laws will apply to the employee if the employee is eligible under both federal and state laws.

Time off for Voting

JJC recognizes that voting is an integral part of being in a community. In almost all cases, and employee will have sufficient time outside working hours to vote. If for any reason this won’t be the case, the employee should contact their supervisor to discuss scheduling accommodations. In Illinois every employee is entitled, after giving sufficient notice, to two hours off work, provided that the employee's working hours begin less than 2 hours after the opening of the polls and end less than 2 hours before the closing.

FlexConnect (Flexible Work Options)

A Flexible Work Schedule opportunity may be available to employees on a regular or temporary basis. Employees must have completed the initial employment period for their current role in order to be eligible. Ideally, employees will have worked for the college long enough to know how to effectively function in their role.

• Compressed Workweek: Allows employees to complete their regular 40-hour workweek in fewer than five days. This is achieved by working longer shifts on fewer days.

The College will maintain a standard workweek (M-F) during the spring and fall semesters to ensure that all departments and services are available in person during regular business hours.

State Universities Retirement System (SURS)

The college participates in SURS and all employees, except student workers and those employees that are considered temporary or intermittent, are required to contribute nine and a half percent (9.5%) of their gross pay. This contribution is a pre-tax deduction. The employer contribution is paid by the state of Illinois. Employees that contribute to SURS do not contribute to the Federal Social Security Program (FICA).

General information regarding SURS may be accessed toll free by calling 1-800-ASK SURS (275-7877) or visiting the SURS website.

State of Illinois College Insurance Program (CIP)

The State of Illinois College Insurance Program (CIP) provides health, dental, and vision benefits for retired employees of public Illinois community colleges. Full-time employees must contribute 0.95% of their gross pay. This required contribution is one of four sources designed to fund the state community college health insurance program. This program is administered through SURS and the State of Illinois. SURS website.

SURS Deferred Compensation Plan (DCP)

SURS offers a supplemental defined contribution plan. This voluntary plan provides employees an avenue to save more and generate additional income in retirement. To make it convenient for employees to build additional savings, newly certified members will be automatically enrolled. The contribution rate will be 3%, deducted before taxes from your paycheck. SURS website.

Tax Sheltered Annuity Program 403(b) and 457(b)

The college provides all employees the opportunity to participate in a Tax-Sheltered Annuity Program. The college has pre-approved companies from which employees can choose a tax deferred investment plan. The college does not contribute to these accounts.

Tuition Waiver

Full-time employees, their spouses, and eligible dependents (eligible dependent children include those who are unmarried and under the age of twenty-six (26) and are dependent upon the employee for support and maintenance at the commencement date of the class) will be granted a waiver for tuition to participate in the Joliet Junior College credit classes. This benefit does not include a waiver for course fees, which will be paid by the employee.

Professional Development and Training

The college has a commitment to the development of its employees. The Professional Development Committee is responsible for the development and implementation of a year-long program of activities which enhance the work performance and environment for all employees at JJC, keeping in alignment with the Core Values.

Performance Management

Communication between employees and supervisors or managers is very important. Discussions regarding job performance are ongoing and often informal. Formal performance reviews are conducted annually. These reviews include a written performance appraisal and discussion between the employee and the supervisor about the job performance and expectations for the coming year.

Wellness Center

Employees may join the Wellness/Fitness Center. Currently membership is free for employees.

Blue Cross Blue Shield IL – Medical Insurance

The college provides two medical insurance plan choice options (PPO, HMO) through Blue Cross Blue Shield of Illinois, for the employee and eligible dependents, effective the 1st day of employment. Employee contribution towards cost of health/dental/prescription insurance is based on a formula, which includes the insurance premium equivalency, employee salary and other factors. Contributions are made on a pre-tax basis.

Prescription Plan

Prescription coverage is provided by Express Scripts for the PPO and by Prime Therapeutic for the HMO.

Blue Cross Blue shield IL- Dental Insurance

Dental insurance (core plan) is provided and included with the base medical employee contribution. An employee may “buy -up” for additional coverage.

Vision Service Plan (VSP)

VSP is Joliet Junior College’s provider for vision care and discounts. Vision insurance (core plan) is included with the base medical employee contribution. An employee may “buy-up” for additional coverage.

Term Life / Voluntary Life / Long Term Disability (LTD)

The college provides 1x the employee’s salary plus $10,000 of term life insurance coverage and double indemnity coverage for the employee at no cost in case of accidental death and dismemberment, effective immediately on the 1st day of full-time employment.

The college provides employees the opportunity to purchase additional life insurance at their own cost, for themselves and their dependents.

Long Term Disability is available at a minimal cost as a supplement to the provisions of the State Universities retirement System (SURS).

Critical Illness

Employee voluntary critical illness insurance provides a fixed, lump sum benefit upon diagnosis of critical illness, which can include heart attack, stroke, paralysis, and more.

FSA / DCA / Commuter

The college provides an IRS Section 125 Flexible Spending Account (FSA). The plan allows for pre-tax deduction by the full-time employees for the purpose of paying reimbursable medical, dental, hearing, vision, dependent care and commuter expenses as per IRS limitations. The employee is eligible to participate in plan the 1st day of employment.

Employee Assistance Program

The college provides access to an Employee Assistance Program (EAP) for employees and their eligible dependents. Our EAP is offered through Evernorth; an integrated employee assistance and work/ life program. Highlights of this benefit include:

Health Screening

Every, fall, JJC provides free annual health screening and lab work to retirees, employees, spouse and/or dependents.

Pet Insurance by MetLife

MetLife Pet Insurance is a voluntary benefit that can not only help cover the cost of unexpected accidents and illnesses, but also things like routine care.

Automotive

The Joliet Junior College Automotive Service Technology Shop provides services to the vehicles of employees in order to provide hands-on experience for its automotive program’s students. The employee will be invoiced for all parts and nominal service fee in lieu of labor charges.

Dining Cafe

A loyalty program to reward employees for your on-going patronage throughout the year regardless of if you pay with cash, credit/debit card or order online. Your points can be redeemed with rewards for discounts on food and drink.

Direct Deposit

Joliet Junior College Employees are encouraged to enroll in direct deposit and may divide their paycheck among multiple accounts.

The description above is a summary of the current benefit program offered and is not intended to be an all-inclusive statement or guarantee of benefits.

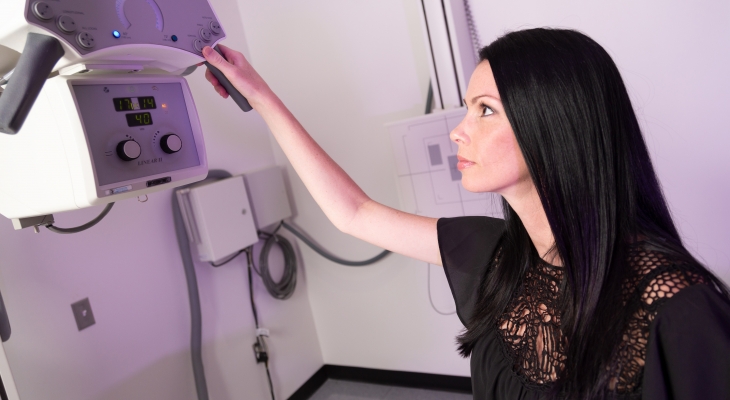

The application for the radiologic technology program will be open from Nov. 1 through Nov. 30. The Radiologic...